A coal-fired power plant in Shuozhou, Shanxi, Chin

Unrest in the Middle East has yielded change in the region, but the effects of anti-government protests are slowly being felt globally as oil soars to its highest price in over 2 years. The New York Times reported that Chinese Energy Specialists revealed that the government plans to announce strict goals for energy conservation.

Make no mistake, this is not an altruistic attempt by the world’s leading energy consumer and greenhouse gas emitter to go green or make strides to curb carbon footprint (energy security far out ways climate change in Chinese policy priorities). China views energy as a national security issue; the concern here is how rising oil prices will effect inflation, export competitiveness, and the country’s pollution problems, according to the NYT article.

China still sees oil as its most important energy source, but as Zhang Guobao, former Energy Czar in China, said, “Oil security is the most important part of achieving energy security,”he went on to say, “Preparations for alternative energies should be made as soon as possible.” China is looking to avoid getting stuck trying to fuel a booming economy on oil while prices skyrocket.

Despite the fact that China is the world’s biggest producer of wind turbines and solar panels at the lowest cost, a majority of its electricity comes from coal. When oil use increased dramatically along with the rise of automobile use, the government pushed extensively for electric cars. This decrease in oil consumption only increased the use of coal. Still, electricity plants tend to be much more efficient than the combustion of gasoline, and stay within the energy use goals China has in mind.

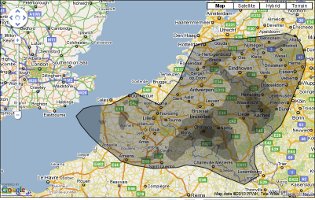

Looking at China’s imported energy sources, the concern coming from Beijing is understandable. Oil from the Middle East, along with the increasing price, gets to China via shipping lanes controlled by economic rivals India and the United States. Iran is also a large importer of crude oil to China. The instability of Iran leaves Russia as China’s most stable oil importer, but only 3% of crude oil imports to China come from its neighbors to the north.

Some are worried that the mostly state run energy industry in China would have to start allocating the limits on energy use. This could cause the decrease in production of certain products, like metals for instance. Stuart Burns on MetalMiner explains;

But who decides, with no free market to set prices on the basis of supply and demand? The impact that could have for resource-hungry activities like steel, aluminum and zinc smelting could be profound in the first half of this decade. China may decide it would rather import metals than import energy, reversing the trend of the last decade. Having temporarily idled some of the 20+ million tons of aluminum capacity, could the Chinese really close a significant portion of it permanently?

As china responds to the effects of rising oil prices, the rest of the world may end up feeling the effects of China’s energy policy. In the more immediate future, China may be looking at energy shortages as their own supplies may not be able to keep up with its rapid economic growth. China’s efforts in lowering energy consumption will no doubt have a number of other benefits along with the primary goals of securing its energy future. The reducing of greenhouse gas emissions will save money not only on energy but on health care costs as the environment in China becomes cleaner and safer for its citizens. The decisions made here will have significant effect on China’s role in energy in the region, as well as its role as a major contributer to climate change.