Home energy efficiency retrofits in Boston have a 39 percent return over five years compared to Microsoft's 7 percent.

Times are tough. If you’ve been unemployed in the last few years, your savings have probably dwindled as you’ve struggled to make ends meet. If you haven’t lost your job, then you’ve hopefully been saving and investing small amounts. But the stock market has been a mess over the last five years, and interest rates for CD’s and treasury bonds are tiny.

If you’re fortunate enough to have money to invest, where should you put your money to guarantee a good return?

Here’s a new investment idea for you: a home energy retrofit. Make your home more energy efficient through low-tech and cost-effective measures like insulation, furnace replacement and sealing your heating ducts.

Huh? Why put money into your house with home prices going the way they’ve been. Well, this isn’t about increasing the resale value of your home: though you can expect that it will at least help. All you really need is to live in your home for five years for this to work in your favor due to the lower utility bills you’ll see every month.

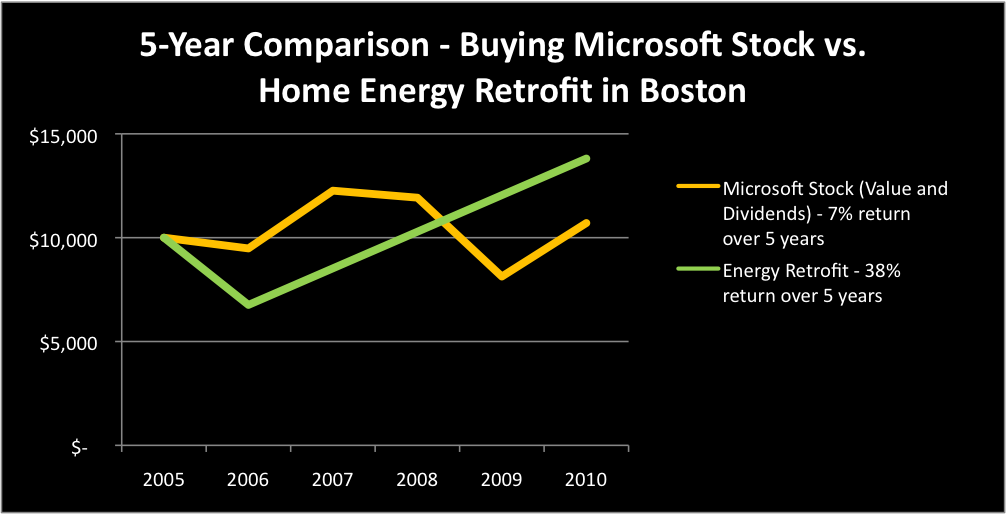

To illustrate the impact of doing a home energy retrofit as an investment, here’s a simplified example. Let’s say five years ago, a homeowner in Boston named Diane was deciding between buying $10,000 of Microsoft stock as an investment and spending that same amount of money on a home energy retrofit to reduce her utility bills. What would have been the better five-year investment?

The Microsoft stock worth $10,000 in June 2005 would have turned into just $10,700 five years later (a return of 7 percent over five years), including the increase in stock price and the dividends paid out over the course of the five years. But it turns out that the home energy retrofit would have been the much better investment. If Diane had spent $10,000 on a retrofit for her 2,000 square foot home in Boston, including attic and wall insulation, sealing and insulating ducts, and air sealing her home to eliminate drafts, the investment would have returned 38 percent over five years, in terms of lower utility bills and increased resale value: even assuming that she only gets back half of the value of her investment at the end.

So… Retrofitting your home is a better investment than the stock market. And that doesn’t even consider the fact that you’ll be more comfortable in your home and you’ll help reduce our country’s dependence on foreign energy sources.

If you’re interested in learning more about how to do a home energy retrofit, who to do it, and how to get as much of it paid for by your utility and the government, estimate your home efficiency then request an energy assessment for a report with recommendations and expected paybacks.

Why would anyone invest in Microsoft these days? Apple just exceeded their market cap and Google is thrashing them in online advertising and soon will be in operating systems and productivity apps, too.

A better comparison would take a bull market vs. energy efficiency. Take, for instance, the Dow Jones in the 1990s. In those heady times, the Dow delivered a whopping 14% return before the crash.

But guess what, energy efficiency outperforms the stock market even in bull markets. Learn more at https://www.wattzy.com/articles/energy-efficiency-vs-the-stock-market

Can you show where you get your numbers? This is a really good point, but I’d like to make sure it’s not just hypothetical.

The chart seems to roughly match Yahoo’s record for MSFT